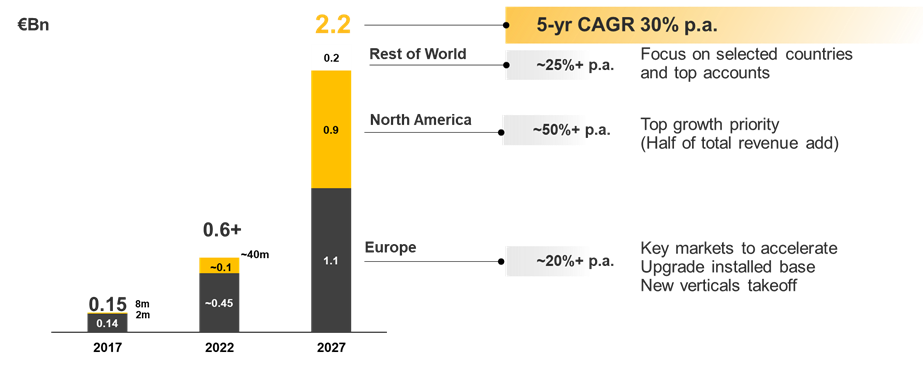

- Top-line expected to grow to €2.2bn by year-end 2027

- EBITDA margin in 2027 estimated to reach 22%

- Growth to be driven by a 10x revenue increase in North America to €0.9/1.0bn, and 2x revenue growth in Europe to €1.1bn

- IoT network of 1bn connected labels and sensors

- VAS to reach 30% of total sales by 2027

- Measurable contribution to the decarbonization of retail

SES-imagotag (Euronext: SESL, FR0010282822), the global leader in digital solutions for physical retail, today published new sales and profit objectives through the year 2027 in a strategic plan titled VUSION ‘27: A VUSION for the Future. The new plan builds on the accomplishments and results of the plan currently in place, VUSION ‘23.

Thierry Gadou, Chairman and CEO of the SES-imagotag group, stated: “It is with great enthusiasm and energy that today we present our VUSION ’27 strategic plan to serve as a roadmap for our operations over the next five years.

Despite the many difficulties and the climate change challenge the world currently faces, we are confident in the ability of global retail to accelerate its transformation, and we believe in the role it can play as a provider of solutions for some of these issues. We are equally confident in SES-imagotag’s ability to continue to play a leading role in the development of transformative solutions for the retail sector.

This year, SES-imagotag celebrates its 30th anniversary. For thirty years, our overriding purpose has been the digitization of physical retail based on solutions, the technology provided by the Internet of Things, the Cloud, data, and artificial intelligence, that transform stores into ultra-efficient, connected, more automated and more intelligent environments, enabling an omnichannel service model and a quality experience to consumers who are becoming increasingly demanding of a seamless omnichannel retail offering.

Physical retail has been under significant economic pressure for several years: eroding operating margins – driven by higher real estate expense, increasing labor costs, and growing competition from digital channels – are leading to shrinking profits. The resurgence of strong inflationary headwinds increases this pressure at every level of the cost structure, decreasing profit potential across the physical retail sector.

Against this complex backdrop, visionary retailers succeed in betting on the omnichannel model and the revitalization of their physical points of sale, enabling – in particular – local e-commerce that is very fast and efficient, and also low in carbon emissions.

Our conviction is that, in the years to come, technology will drive the acceleration of the evolution toward “phygital” retail: local, fast, efficient, convenient, offering local jobs of higher quality, and respectful of the environment, of urban centers and of consumers.

And this is the magnificent purpose of SES-imagotag, the uncontested global leader driving the digital transformation of retail, whose growth and development are accelerating as a result of a growing demand and an incomparable capacity for innovation. SES-imagotag is a technology company whose usefulness and “raison d’être” become clearer by the day for all of our associates.

Our ambition of strong profitable growth is based on the pillars built over the course of the past years: a global presence, a technological platform, high value-added solutions, a robust business model, a resilient supply chain, and a like-minded and motivated entrepreneurial management.

Today, SES-imagotag is recognized as the reference company in Retail IoT. The unmet need remains immense in Europe, and the huge potential market in North America is beckoning to us. 2023 is shaping up to be a watershed year in terms of innovation launches.

We thus foresee significant work ahead, in the service of a common good: the modernization of retail. We also anticipate compelling value creation for our clients, our associates, and our shareholders, who are growing in numbers and in international representation.”

MARKET AND STRATEGY

VUSION ‘27 Backdrop and Context: Physical Retail under Pressure

The context within which SES-imagotag currently operates, and in which the VUSION ‘27 plan has been developed, is a physical retail industry that faces significant and model-shifting pressure from several directions:

- The current macroeconomic backdrop, with galloping inflation in many key markets and looming recession across the globe, is driving rising labor and energy costs (among others) and, consequently, margin erosion and decreasing profits;

- Dynamics in the retail sector are changing with online shopping becoming more prevalent, consumer behavior shifting toward new preferences and ways of shopping (i.e. the acceleration of e-commerce and social commerce), labor shortages, and decreasing in-store traffic.

These market realities are leading retailers to examine and re-think their operating models to ensure their relevance to consumers, and to develop business models that can generate adequate operating margins and profits going forward.

Digitizing the Retail Sector: Despite many headwinds, physical stores hold significant value-creating potential

Against this backdrop, SES-imagotag’s products and solutions are proving to be very effective tools in retailers’ efforts to transform the current difficult operating environment into a more positive setting for their businesses, enabling them to drive operating efficiencies within their physical stores under new market realities, and creating value for themselves, their suppliers, and their customers.

ESL adoption is accelerating on a long-term trajectory, as ESL technology increasingly becomes the backbone technology of in-store digitization. As the global ESL leader SES-imagotag has been driving transformative innovation in the ESL industry, advancing from technological shifts such as migrating ESLs to the cloud, to the current strategic focus on providing digital shelf systems, i.e. cloud-connected sets of integrated shelf devices (ESL, micro-cameras and sensors).

Specifically, and as discussed in further detail in this strategic plan, SES-imagotag’s Digital Shelf System enables stores to manage with greater precision, agility and insight:

- Price and promotions;

- Order fulfillment for local e-commerce;

- On-shelf availability, real-time shelf monitoring, inventory management data and planogram compliance

- In-store location of products, staff and shoppers

- Retail media, including digital interactions with consumers, customer insights and retail-CPG supplier interaction

- Personnel management.

The efficiencies and insights created by these in-store digital solutions, among others, are estimated to enhance retailer and CPG company operating margins by several points — estimated to be in the low to mid-single digits — thus partially off-setting the impact of adverse macroeconomic conditions on the operations and P&Ls of retailers.

The Market Opportunity

The size of the global addressable Electronic Shelf Label market is estimated by the company at around 10 billion units. To date, the estimated ESL installed base is around 700 million units, i.e. 7% penetration, of which SES-imagotag accounts for approximately 50%.

Based on these numbers, the unmet potential demand for ESLs is over 9 billion units, pointing to an extremely large addressable market for SES-imagotag to expand its business in the coming years. By way of perspective, SES-imagotag currently has an installed base of around 350 million ESLs.

ESLs are the backbone of physical retail digitization

There is a larger, more disruptive and transformative opportunity that is being created via the growth of the ESL installed base. Electronic shelf labels enable a growing portfolio of very powerful software, services and non-ESL solutions (VAS) for digitizing physical stores. These solutions, in turn, enable physical stores to transform themselves into ultra-efficient, connected, increasingly automated, intelligent environments, enabling an omnichannel service model and a quality experience to consumers. VAS is expected to grow even faster than ESL installations over the next five years, underscoring a fast-growing and highly profitable growth vector for the company, and highlighting the company’s strategic direction.

Driving Sustainability in Physical Retail

SES-imagotag’s purpose is to invent IoT and digital technologies that create a positive impact on society by enabling sustainable and human-centered commerce.

The company’s shared value-creation model is structured on three pillars:

- Roadmap for Positive Retail, which aims to develop ultra-low carbon IoT devices; contribute to retail’s Net-Zero target; and enable better and more sustainable stores, thus protecting jobs, consumers and communities;

- Be a Great Place to Work, fostering and promoting diversity and equality, long-term motivation, human capital development, overall well-being at work, and meaningful social dialogue; and

- Long-Term Stakeholder value, based on world-class governance standards, measurable long-term positive impact and stakeholder value, and transparency and quality of ESG reporting.

Retail supply chains account for 25% of the world’s GHG emissions according to the World Business Council for Sustainable Development. Within this context, SES-imagotag is in the process of building a Net-Zero contribution plan which aims to de-carbonize its own products and contribute to the de-carbonization of retail. To de-carbonize its products, the Company seeks to increasingly migrate the in-store technology it provides to be cloud-based and infraless, refurbish and recycle ESLs, and to eco-design lower carbon and battery-less ESLs through its Vusion-E program. To contribute to the de-carbonization of retail, SES-imagotag’s solutions enable paperless stores, local e-commerce, reduction of food waste, and better information at the shelf influencing responsible consumption.

In October 2022, SES-imagotag’s sustainability efforts were recognized via a Platinum ranking from EcoVadis, the world’s reference of business sustainability ratings, placing the Company in the top 1% of all companies evaluated on environmental factors, labor and human rights, sustainable procurement, and ethics. Also in 2022, SES-imagotag obtained the ISO 14001 certification, confirming that the Company’s environmental management system complies with a series of requirements as outlined by that ISO standard.

Moreover, SES-imagotag’s solutions have an important role to play in promoting sustainability within the growth of e-commerce. Technology-enabled stores are efficient e-commerce assets, as they can carry out in-store fulfillment, ensure extra-fast pick-up and express delivery, and can handle returns and services. It is estimated that in the future, IoT-enabled stores could fulfill at least 50% of total e-commerce online sales. In providing an alternative to the direct-to-consumer logistics model under which e-commerce predominantly operates, technology-enabled stores could contribute to minimizing the need for many millions of square meters required by new e-commerce fulfillment centers, thus decreasing the consequent significant level of incremental CO2 emissions that these new fulfillment facilities would generate.

SES-imagotag’s ESG strategy and priorities are overseen by an International Advisory Board, comprised of six global leaders with vast and high-level experience in the CPG, technology and public sectors, and by the ESG, Nomination and Remuneration Committee of the Board of Directors.

TECHNOLOGY AND PRODUCTS

Core Expertise and Capabilities: Leveraging proprietary technological innovation; Making the Physical Store a Digital Asset

To develop its innovative retail digitization solutions, SES-imagotag’s R&D is carried out in seven excellence centers located in Europe (France, Austria, Germany, Ireland, and Croatia), Asia (Taiwan) and the United States (Chicago). The Company’s R&D staff totals 200+ people, and accounts for 30% of global headcount. At present, R&D spend is around 5% of annual revenue.

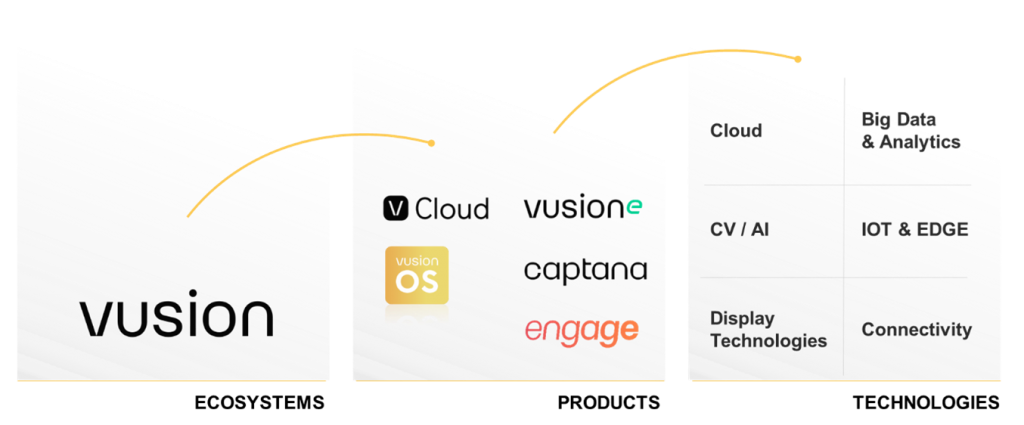

Retail digitization requires a scalable, secure, open, future-proof Cloud-to-Edge internet-of-things (IoT) management platform, that is able to ensure ongoing innovation, optimization, and improvement in the solutions it provides. Adhering to these requirements, SES-imagotag’s R&D team has achieved many breakthrough innovations in the past years and has developed core expertise and capabilities that enable it to imagine, invent and design the solutions it provides to the world’s physical retailers. The Company’s solutions operate in an ecosystem it has named VUSION, and its products leverage cutting edge technologies to digitize physical retail.

SES-imagotag has a high-value portfolio of strong IP assets, with more than 110 active patent families, and over 500 active patents.

These technologies, competencies and innovations enable SES-imagotag’s overriding objective: Making the Physical Store a Digital Asset.

SES-imagotag’s Products and Solutions: Leveraging cutting-edge technology to transform stores

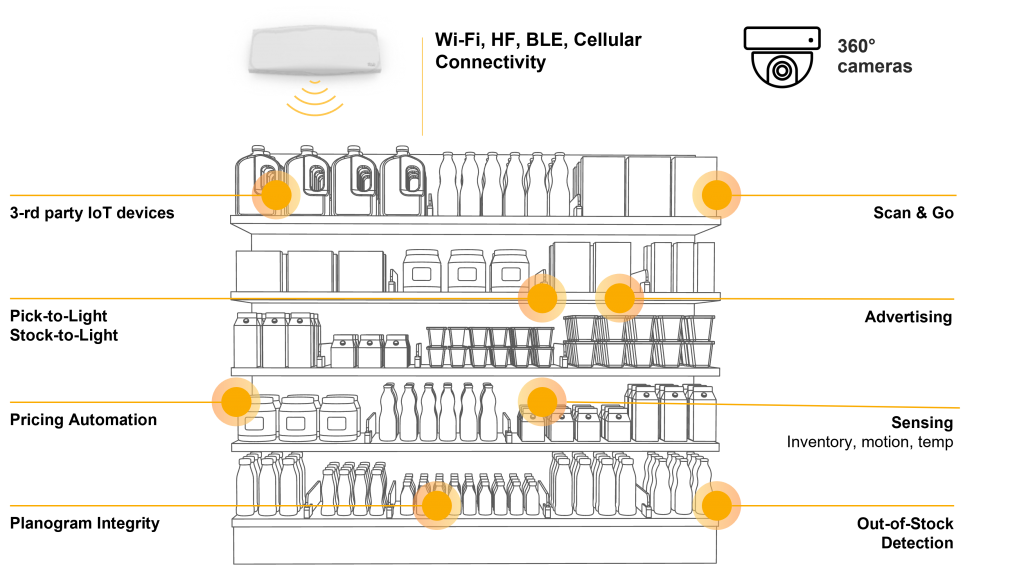

Based on the technology described above, SES-imagotag’s business has evolved from the sale of proprietary electronic shelf label hardware, to the provision of a growing Cloud-based platform (with the aim to become largest IoT network in retail), services and non-ESL solutions (abbreviated as VAS).

In stores, VUSION drives the digitization of the physical retail sector by providing the following benefits:

- Pricing automation

- Optimized picking and replenishment

- Real-time shelf monitoring and analytics

- Digital advertising

- In-store search and flash

- In-store mobile experience

These are transforming traditional physical retail outlets into digital assets.

Captana: Shelf Transparency Delivered

The Captana solution is an essential component in the Digital Shelf System. Based on ultra-low power wireless micro-cameras and sensors powered by cloud and AI, Captana allows for permanent shelf-monitoring. Through cameras and sensors, Captana transforms pictures into structured data by processing image data obtained at the store shelf in the Captana Cloud using artificial intelligence, machine learning and computer vision. It is differentiated from competing solutions through its ESL and sensor synchronization technology that drives higher accuracy and easier implementation by leveraging the ESL infrastructure. Captana addresses at-shelf issues such as out-of-stocks, which are estimated to cost retailers up to 8% in annual revenues. It also aggregates, processes and analyzes data produced in stores, but that are not used to their fullest potential for the benefit of category management, store operations, e-commerce and online shopping, marketing and supply chain optimization.

Captana enables in-store optimization at the shelf, with the following positive impacts to a store’s operating margin, as well as benefits for CPG brands:

- In-store labor automation;

- Increase in on-shelf availability;

- Improved inventory accuracy;

- Back-office automation;

- Customer experience.

Engage: The Next Big Digital Media is the Physical Store

The objective of Engage is to ensure that retailers are leveraging the full potential of the foot traffic in their stores. The concept is to create a new digital touchpoint at the shelf by:

- Running dynamic digital campaigns, with digital content delivered at the shelf;

- Enabling shopper interactions by providing the ability to engage digitally with shoppers at the moment of purchase;

- Measuring the impact of promotional campaigns in real-time, and obtaining insights into consumer behavior; and

- Generating an additional revenue stream by leveraging in-store media ad spend and monetizing in-store foot traffic.

The insights generated by the Engage platform enable CPG companies to communicate with their consumers digitally via ads at a prime location: the store shelf. This in turn creates a new revenue stream for retailers.

The technology developed by SES-imagotag, and the solutions enabled by this technology, provide the tools that stores require to become tech-enabled digital assets. SES-imagotag’s growth plan for the next five years is built on the accelerating adoption of these technologies by the world’s largest retailers.

VUSION ‘27: GLOBAL GROWTH AND NEW FRONTIERS

Transformation Plan

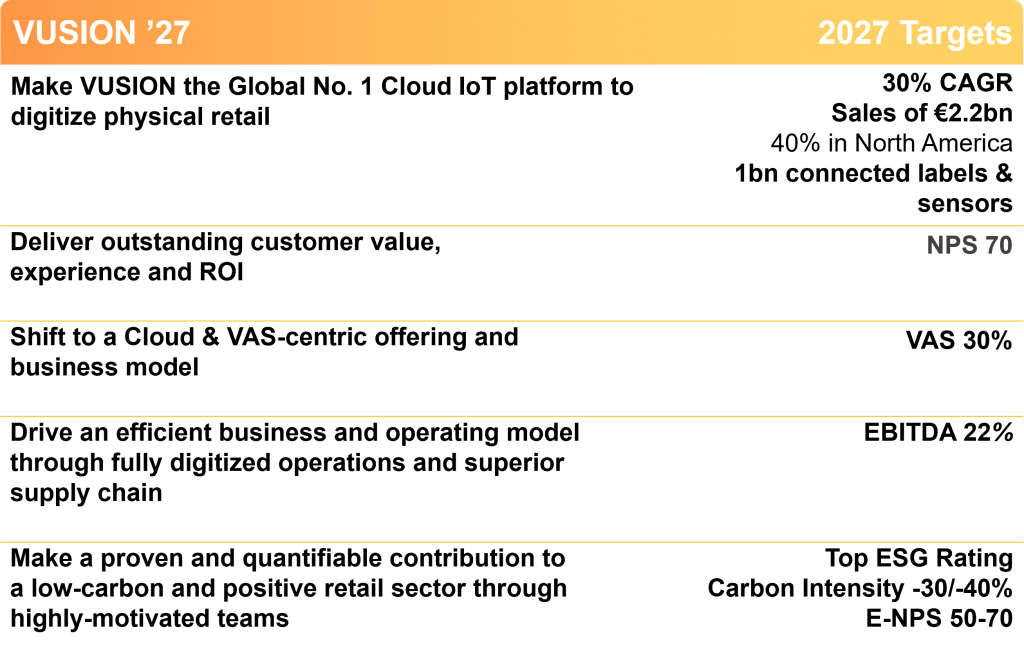

SES-imagotag’s new strategic plan, VUSION ‘27, is underpinned by a transformation plan, comprised of the following objectives to be met by year-end 2027:

- Growth and Leadership: SES-imagotag aims to retain and expand its position as the Global No. 1 cloud IoT company for retail and industry. The top-line objective is to reach 1 billion connected IoT devices, and revenue of €2.2 bn (for an estimated CAGR of 30%), with 40% of sales generated in the United States;

- Customer First: Deliver outstanding customer value, experience and ROI, for a net promoter score (NPS) of 70;

- Value-added Software and Services (VAS): Cloud and revenue from software, services and non-ESL solutions (VAS), based on an open IoT platform, to account for 30% of total revenue;

- Top Operational Performance: Achieve an efficient business and operating model through fully digitized operations and a superior supply chain, leading to an EBITDA margin of 22%;

- Positive Impact: Make a proven and quantifiable contribution to a low-carbon and positive retail sector, as recognized by top ESG ratings, and be a great place to work for our employees.

Global Footprint Expansion: Strategy & Roadmap

At present, SES-imagotag’s products and services are sold to over 60 countries across the globe through 19 regional hubs, with a concentration in Western Europe and North America.

Until recently, the Company’s business and growth had been concentrated in Europe which, in 2022, still represents around 75% of total revenues. However, over the past few years this growth profile has begun to shift, with the United States becoming a market that strongly contributes to growth. This trend is expected to continue over the next five years.

Growth by Region

Europe: Elevating our historic market

SES-imagotag’s Europe region, which operates through 12 offices and branches with 180 employees, currently accounts for 75% of the company’s total revenue. Top-line is expected to more than double to €1.1bn by year-end 2027. This region comprises the company’s most mature markets, with high levels of penetration in France, southern Europe, Benelux and Scandinavia. Markets such as Germany and the UK present significant opportunity for future growth as ESL and digital adoption are set to catch-up rapidly.

In the region’s more highly-penetrated markets, growth is expected to be partially driven by further deploying the large existing customer base and upgrading the installed store base increasingly to the Cloud platform and VAS solutions. The Vusion ‘27 plan envisions converting upward of 25,000 existing stores to Cloud-based solutions.

The ongoing development of new verticals will drive further growth. This includes new retail segments such as hard discount, home furnishing, travel retail, health and beauty, sporting goods, fashion, DIY, convenience stores, and gas stations, as well as new customers in manufacturing, automotive, logistics, office signage and healthcare.

North America: Scaling up in the world’s largest retail market

SES-imagotag’s North American region operates through 4 offices (Chicago, Dallas, Montreal and Mexico City), and 50 employees (expected to reach 100 by year-end 2023). All 4,000 stores across the region use the VUSION cloud platform and some of the Company’s VAS solutions. Revenues already total over €100m in 2022.

The total addressable market in North America is estimated to be more than 3 bn ESLs with much lower penetration than Europe. SES-imagotag’s growth ambitions in the region are based on an assumption of rapid adoption catch-up, fueled by increasing price and promotional velocity, the shift to in-store fulfillment of online orders and the accelerating need for shelf automation. SES-imagotag North America’s top-line is expected to increase ten-fold to a range of €0.9 to €1bn over the next five years.

Rest of World

In the Rest of World, SES-imagotag will continue to develop its presence in selected markets through its existing regional hubs and strategic partners network in Asia, South America and Middle East/Africa. The expected average growth in these markets is around 25% per annum throughout the period, leading to a top line of approximately €200m. These markets will become a significant growth reservoir in the longer term.

Financial Plan

| Key Financial Objectives (€m and as % of revenue) |

2017 | 2022e | 2027e |

| Revenue | 153 | 600+ | 2,200 |

| VCM | 40 26% |

125-132 21-22% |

700 32% |

| Operating expense | (34) 22% |

(72) 12% |

(220) 10% |

| EBITDA | 6 4% |

53-60 9-10% |

480 22% |

Drivers of Revenue growth

Revenue growth in the VUSION ’27 plan is estimated on a 5-year CAGR of 30%+ to €2.2bn, with the assumption of 1 billion connected IoT devices among SES-imagotag’s customers by year-end 2027. This growth will be driven by significant market penetration acceleration in the United States, the migration of existing ESL customers in Europe toward cloud-based solutions, the penetration of new markets in the Rest of World, and the development of new retail sectors and other verticals.

VAS is expected to represent 30% of revenue at year-end 2027, up from 16% in 2022.

Drivers of Profitability growth

EBITDA in 2027 is expected to reach €480m, with EBITDA margin expanding from approximately 10% in 2022, to an anticipated 22% in 2027. The drivers of this significant profitability improvement are assumed to be a widening of gross margin, resulting from the growth of VAS (which generates a higher gross margin than ESLs) in the revenue mix, and a gradual improvement in operating leverage.

Financial structure

Over the next five years, SES-imagotag’s potential financing requirements will be primarily met through debt.

The maximum leverage the company expects to reach is a Net Debt to EBITDA ratio of 2.0x. In the event that SES-imagotag takes on new debt, it could progressively shift from bullet to amortizable debt, and from European borrowing to more debt taken on in the United States.

The Company is also targeting a first dividend in 2024 (based on 2023 results).

Contact:

Investor Relations: Labrador – Raquel Lizarraga / +33 (0)6 46 71 55 20 / ses-imagotag [at] labrador-company.com

Disclaimer

This press release contains forward-looking statements. All statements other than statements of historical fact included in this press release are forward-looking statements. Forward-looking statements give the current expectations and projections of SES-imagotag relating to its financial condition, results of operations, plans, objectives, future performance and business. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target,” “believe,” “expect,” “aim,” “may,” “estimate,” “plan,” “project,” “will,” “should,” “would,” “could” and other words and terms of similar meaning or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond SES-imagotag’ control that could cause the SES-imagotag’ actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include those discussed or identified under Chapter 2 of the Universal Registration Document of SES-imagotag, approved by the French Autorité des marchés financiers (AMF) on 7 July 2022 under number R.22-033 and available on SES-imagotag’s website (www.vusion.com) and the AMF’s website (www.amf-france.org). Such forward-looking statements are based on numerous assumptions regarding SES-imagotag’ present and future business strategies and the environment in which it will operate in the future. Accordingly, readers of this press release are cautioned against relying on these forward-looking statements. These forward-looking statements are made as of the date of this press release. In addition, the forward-looking financial information included in this press release has not been audited by SES-imagotag’s statutory auditors.

This press release does not contain or constitute an offer of securities for sale or an invitation or inducement to invest in securities in France, the United States or any other jurisdiction.