SES-imagotag refutes in the strongest possible terms each of the allegations made against it in the report produced by Gotham City Research on Thursday, June 22, 2023, under the title “SES-imagotag: The Circular Dance with a Chinese Twirl.”

The present document provides factual, precise, and verifiable answers which shed light on the errors contained in the report. The fraud that is alluded to in the report does not exist; there is no double counting of circular revenues with BOE; the consolidation of the Group’s subsidiaries and parent company’s revenues is consistent with the consolidated revenue, which is generated exclusively by sales to external customers. The capitalization of SES-imagotag’s R&D investments is compliant with IFRS accounting standards. Consequently, there is no over-statement of the company’s revenue or profit.

SES-imagotag faces this new chapter calmly, true to its approach which emphasizes transparency and respect for rules and standards. But the company is also conscious of the gravity of the consequences of such a maneuver for the entirety of its ecosystem: employees, customers, partners, and shareholders. That is why SES-imagotag reserves the possibility to exercise all rights for future legal action if need be.

SES-imagotag is a fast-growing, innovative company, and the world leader of a sector which is developing rapidly. 2023 represents a new year of growth and improving profitability.

Hereunder, the Group presents the following clarifications and denials set out in this document which address in detail the topics listed below:

- The consolidation of the revenues of the subsidiaries and the parent company (forgotten in the Gotham City report), which is an operating company, net of intercompany flows, is equal to the consolidated Group revenue.

- Sales of components to BOE are neutralized in consolidation and do not enter into the revenues of the Group. Therefore, there is no round-trip double-counting between SES-imagotag and BOE. The Group revenue is only generated with external customers.

- The consolidation of the subsidiary in China (the “JV”), which was majority-owned and controlled by the Group until September 2022, is compliant with IFRS accounting standards.

- Capitalized expenses are consistent with R&D and IP investments and compliant with IFRS accounting standards.

- Financial statements are not misstated. Revenue and EBITDA are not overstated.

- The relationship with BOE is performed at arm’s length basis and subject to strict governance and supervision rules.

- SES-imagotag follows a strict multi-sourcing policy. Purchase prices from BOE have not evolved differently than from other EMS.

- SES-imagotag does never present itself as a « SaaS company » but as the leading Retail IoT platform, with a large majority (85%) of its revenues coming from ESL hardware, and 15% of its revenues comes from “Software, services and non-ESL solutions (VAS)”.

- Walmart contract is profitable and consistent with the Vusion’27 strategic plan.

-

The consolidation of the revenues of the subsidiaries and the parent company (forgotten in the Gotham City report), which is an operating company, net of intercompany flows, is equal to the consolidated Group revenue.

Gotham City claims the following (p. 7): “SESL’s consolidated revenue does not reconcile to the sum of its subsidiaries’ revenue”

SES-imagotag’s consolidated revenue includes the contribution from all the companies it controls. This is the case for the company’s subsidiaries for which the statutory revenue is disclosed in Note 24 of the financial statements published in the 2022 Universal Registration Document.

The total revenue derived from the standalone financial statements of the company’s subsidiaries in the scope of consolidation as at December 31, 2022 amounts to €501m. However, this amount does not constitute SES-imagotag’s consolidated revenue because it does not include the revenue generated by SES-imagotag as an operating company, a crucial fact that Gotham City omitted to take into account in its assumptions. When the revenue from SES-imagotag as an operating company and the revenue for the first nine months of 2022 from the Chinese JV are taken into account, and after elimination of inter-company accounts, the Group’s consolidated net revenue totals €620.9m for FY 2022, as reported. This revenue is generated in its entirety by sales to external clients.

This specific control is clearly part of the procedures carried out by the Group’s external auditors, as part of their audit of the consolidated financial statements.

-

Sales of components to BOE are neutralized in consolidation and do not enter into the revenues of the Group. Therefore, there is no round-trip double-counting between SES-imagotag and BOE.

Gotham City claims the following (p. 4, p.7, p. 6): “2020-2022 revenues are overstated by at least 7%-13% and 2022 / EBITDA is overstated by 106%” “At least 7%-13% of 2020-2022 SESL revenue are of suspect quality as they to seem to include round-trip transactions and sham revenue from its China JV (that are unrelated to ESL revenue).” “Without these sources of revenue, SESL would have missed 2021 & 2022 revenue guidance.” “2019-2022 revenues are overstated by at least 7%-13%, which means most – if not all – of EBITDA is overstated as well.”

The transactions between BOE and SES-imagotag are related-parties transactions and are reported in our Annual Reports / Universal Registration Documents available on the website of the company.

Starting in 2021, SES-imagotag has purchased strategic components from Eink, in order to control their sourcing. SES-imagotag has then resold these strategic components to the ESL assembly factory of BOE, who assembles and sells the finished ESLs to SES-imagotag.

In order to indeed avoid double counting of related revenues and the costs, the initial purchase from Eink and sale to BOE of components are neutralized in the Group consolidated financial statements. There is consequently no double counting or round-trip transactions in the Group consolidated financial statements. This is part of the procedures carried out by the Group’s external auditors, as part of their audit of the consolidated financial statements.

The Group revenue is therefore only generated with external customers.

There is no double counting related to round trip revenues in the Group consolidated financial statements, and therefore the Group consolidated Revenues and the Group consolidated EBITDA are not overstated.

Note: In 2018 the China JV did not exist and BOE was acting as a reseller of SES-imagotag products to kick-off sales in China. In 2018, SES-imagotag sold products and services to BOE to launch such activities. In 2019, the JV was incorporated and BOE stopped acting as the Group reseller in China.

Therefore, such transactions between SES-imagotag and BOE stopped.

-

The consolidation of the subsidiary in China (the “JV”), which was majority-owned and controlled by the Group until September 2022, is compliant with IFRS accounting standards.

Gotham City claims the following (p.11): “Despite owning 51% of the JV, SESL consolidates 100% of its financials onto its own consolidated financial statements. Whether this accounting treatment is permissible or not, we believe it is non-obvious and very misleading to investors.” “SESL would’ve missed revenue guidance in both 2021 and 2022 (EUR 400 million and 600 million revenue guidance in 2021 and 2022, respectively) were the company to have elected the more conservative equity method to account for the JV”

The contribution of BOE Digital Technology Co Ltd (the “JV”) to SES-imagotag Group consolidated revenues was €19m in 2022 and not €31m as stated by Gotham City.

Regarding the consolidation method, it is reminded that SES-imagotag owned 51% of this entity and controlled its Board of Directors. It was therefore an obligation as per the IFRS accounting standards to consolidate in full integration the financial statements of this company. Under these rules, it was not possible for SES-imagotag to “have elected the more conservative equity method to account for the JV”. SES-imagotag fully consolidated the JV’s P&L and the balance sheet in its consolidated financial statements as it was required to do as per the IFRS accounting standards.

Consequently, SES-imagotag had to fully consolidate the revenues of this entity and would not have missed its revenue guidance even if the company had been consolidated under a different – but not allowed – accounting method. Since Q4 2022 this entity is not anymore consolidated, but the Group continues to grow fast with an unchanged target of €800m in 2023.

Gotham City claims the following (p.13, p.16): “ESL revenue doesn’t seem to account for the JV’s 2019-2022 revenue, and SESL doesn’t explain what they are. Worse, SESL adds to the confusion by including the JV’s revenue as “rest of the world” revenue, as if the JV’s revenue were ESL revenue” “The JV’s 2019 revenues may exist, but mostly come from the sale of non-ESL digital signage” “Concern that « The JV’s revenue comes from unexplained, possibly suspect sources, akin to roundtrip revenue between it and BOE »”

As in all other countries where the Group is active, the range of products includes Electronic Shelf Labels as well as other products and services including digital signage solutions. This last is a specialty of BOE and constitutes one of the synergies between the two groups.

Low ESL market prices and margins in China led the company to slow down efforts on ESL, and to focus more on digital signage. However, the subsidiary profitability still remained very low and the COVID pandemic made it more difficult to operate the subsidiary. The investment required to reach a critical scale led to the conclusion that SES-imagotag had better capital allocation priorities (notably in America). As a result, it was decided to sell the subsidiary to a partner with the right local scale and expertise.

Gotham City claims the following (p.12): “SESL divested its entire 51% JV stake in Q3 2022 for EUR 13.8 million – the same amount it paid for it in 2019. We find this is a suspiciously low price, given the JV’s revenue grew ~ 8x since SESL first purchased the stake. This low valuation implies to us that the JV failed to grow ESL revenue”

As stated on page 197 of the 2022 Universal Registration document, “On July 22, 2022, the company’s Board of Directors approved the transfer of the 51% share that the Group held in its joint venture in China in exchange for 8.9% of BOE-YiYun, a Chinese tech sector company”.

The 51% stake in the JV was sold against a 8.9% stake in the company YiYun Technologies and

SES-imagotag incurred no cash settlement for this transaction.

The only cash impact in the Group’s financial statements stemming from this transaction is a consolidation change in scope impact. When the Group stopped consolidating the China JV, it also stopped consolidating the cash position of the JV resulting in a negative impact on the overall cash position of the Group of €13.8m (the cash position at the time of the divestment).

As in all in-kind transactions, an external fairness opinion performed by an independent expert confirmed the valuations of both YiYun and BOE Digital Technology Co Ltd for this transaction. And according to our governance rules regarding related parties transactions, the BOE board members abstained from all votes regarding this transaction.

-

Capitalized expenses are consistent with R&D and IP investments and compliant with IFRS accounting standards.

Gotham City claims the following (p.5, p.18): “106% of SESL EBITDA 2022 is of doubtful quality after accounting for suspect 2022 revenue and the capitalization of what appears to be standard operating expenses.” “Over 5 years, SESL’s capitalized expenses have been 2x that of Pricer’s as a % of revenue. SESL consistently capitalizes far more than Pricer, even though they are in the same business. We believe this excess difference is improperly capitalized and should be treated as operating expenses (FYI, if we were to apply US GAAP standards instead of IFRS, SESL’s cost capitalizations would look even more improper).”

SES-imagotag’s strong growth and leadership positions are fueled by all the innovations it has brought to the industry. In the past few years, SES-imagotag has triggered some major innovation projects, including Vusion Cloud, Vusion OS, Captana, and Pulse as examples. And some of those key innovations, which required sizeable investments, have led to the partnership recently announced with Walmart US.

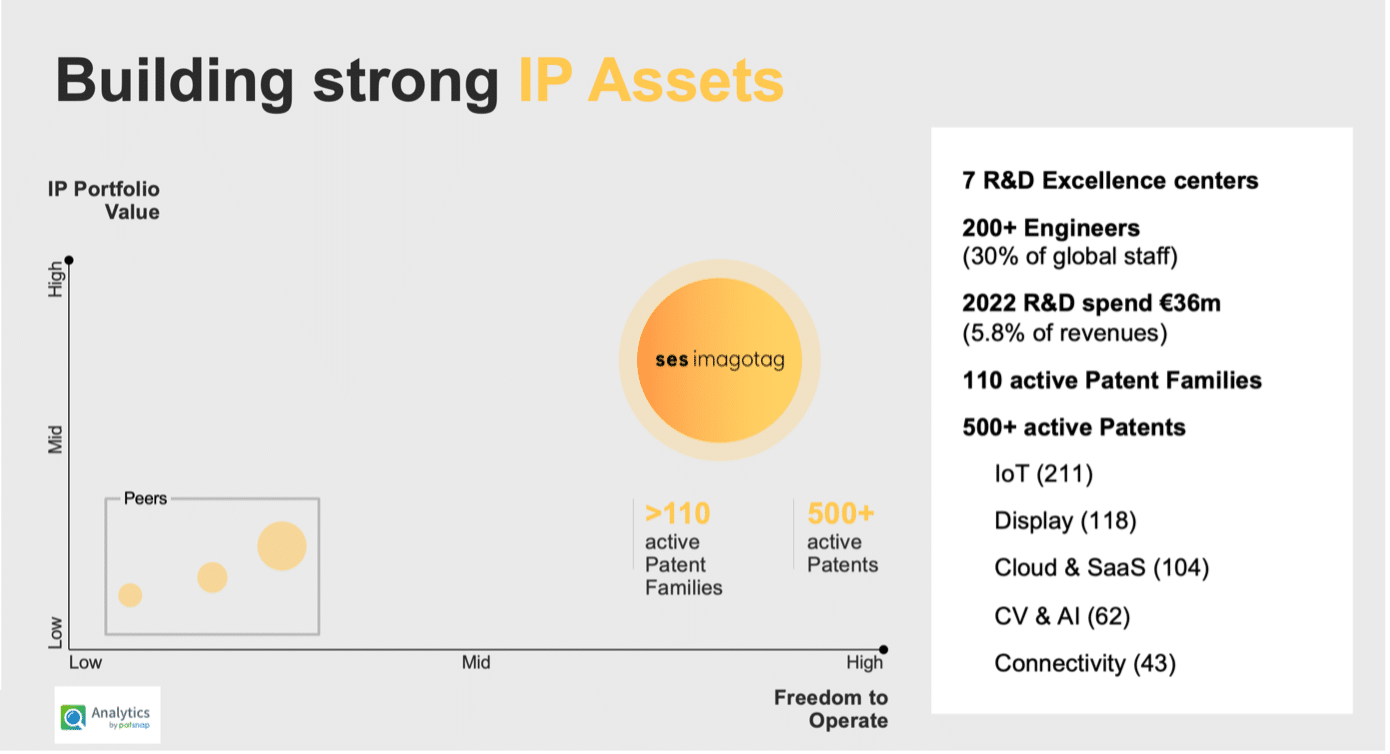

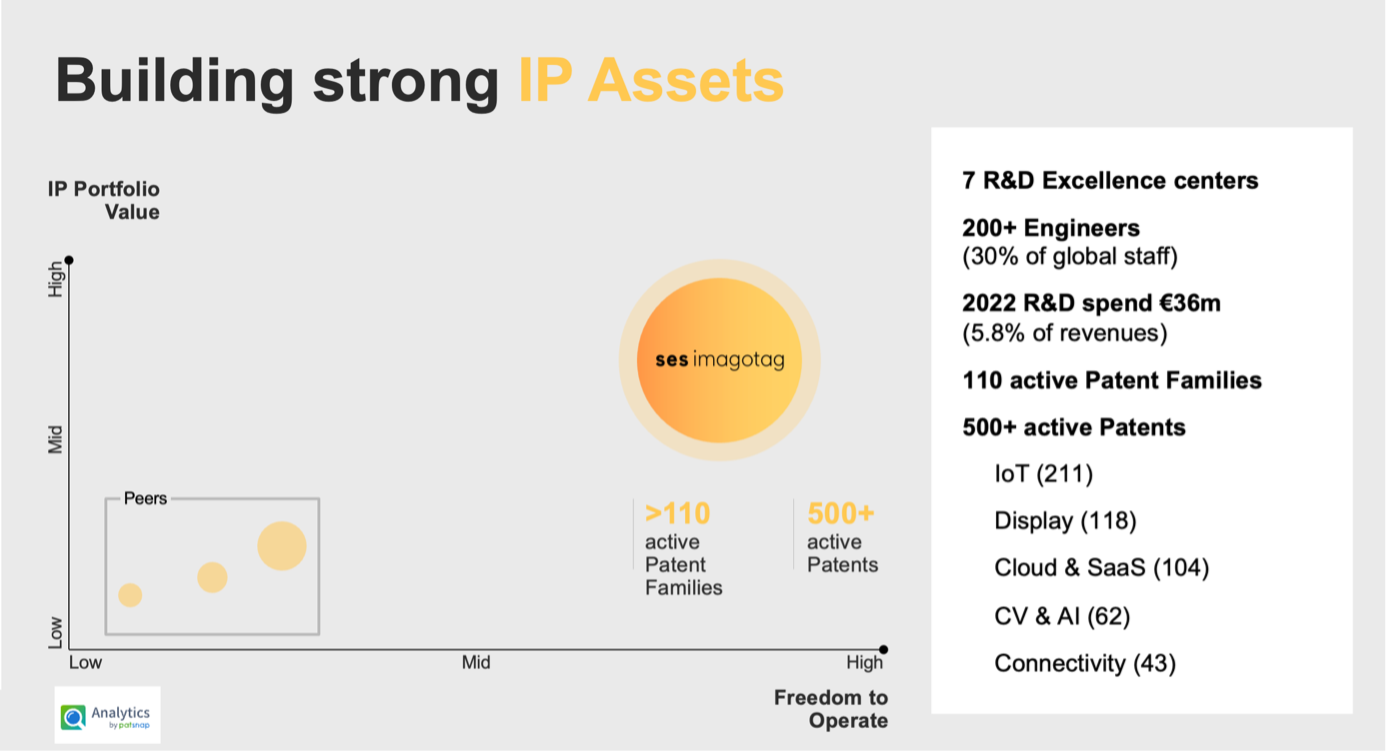

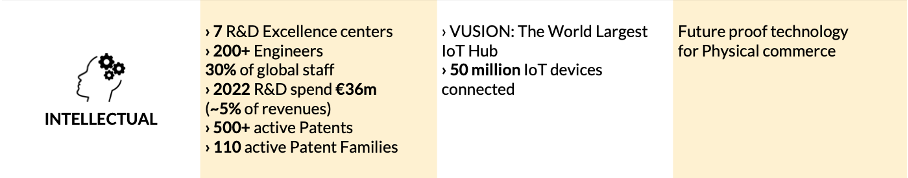

To this end, each year we submit many patent applications and we have built an IP portfolio that is unmatched among our peers.

SES-imagotag employs large R&D teams (see above) to develop these products and capitalizes part of the time they spend on these development projects, in compliance with IFRS accounting standards.

The Group uses time sheets populated by R&D teams and controlled by its Finance Department. Only the portion of their time dedicated to viable and revenue generating products and solutions is capitalized. The remaining part of their time is expensed.

A dedicated audit procedure is carried out by auditors on this accounting treatment, as part of their audit of the consolidated financial statements.

This accounting method complies with IFRS accounting standards and has been applied for many years by the Group.

SES-imagotag invests far more than its peers in innovation which provides a foundation of its leadership, fast growth, VAS growth and profitability improvement.

-

Financial statements are not misstated. Revenue and EBITDA are not overstated.

In summary of the above answers 1) to 4), it is confirmed that:

- The consolidation of the revenues of the subsidiaries and the parent company (forgotten in the Gotham City report), which is an operating company, net of intercompany flows, is equal to the consolidated Group revenue.

- Sales of components to BOE are neutralized in consolidation and do not enter into the revenues of the Group. Therefore, there is no round-trip double-counting between SES-imagotag and BOE. The Group revenue is only generated with external customers.

- The consolidation of the subsidiary in China (the “JV”), which was majority-owned and controlled by the Group until September 2022, is compliant with IFRS accounting standards.

- Capitalized expenses are consistent with R&D and IP investments and compliant with IFRS accounting standards.

Therefore, none of the allegations are valid, Revenue and EBITDA are not overstated and the financial statements are not misstated.

Regarding Free Cash Flow

SES-imagotag has consistently reported on its Free Cash Flow generation every semester.

This Free Cash Flow is totally transparent. It includes, in particular, the generation of cash from the net income / loss but also the high investments in innovation (mentioned above) and the working capital requirements resulting from the strong growth spurred by our innovations and our international expansion. Any comparison to our peers (e.g. like Pricer in the Gotham City report) should factor in growth (working capital impact) and innovation (Capex impact).

-

The relationship with BOE is subject to strict governance and supervision rules

The report casts suspicion on the governance of the company and the management of supposed conflicts of interest with BOE.

As a reminder, the contracts for which BOE is a supplier are always the result of a formal request for proposal, are submitted to French rules on approval of related-party agreements (and therefore approved by the shareholders’ general meeting on an annual basis), and are subject to voting at the Board of Directors level without the participation of non-executive directors who represent BOE.

Since 2018, the majority of the members of the Audit committee and of the ESG/Nominations/Remune-ration committee are independent directors who are European or American, who all have backgrounds that include broad experience at the senior executive level of world-renowned companies, and whose skills and reputations are well-known, especially in matters regarding corporate governance.

-

SES-imagotag follows a strict multi-sourcing policy. Purchase prices from BOE have not evolved differently than from other EMS.

Regarding our relationship with BOE as a supplier:

- Gross errors on all the COGS estimations and interpretations in the Gotham City report

Gotham City claims the following (p.20): “We estimate that soon after BOE became SESL’s largest supplier in 2019, SESL’s average cost per label produced declined through 2021, improving SESL’s margins” “SESL’s per unit costs started rising just as BOE and its interests began diverging in 2022”

SES-imagotag’s ESL product range includes many sizes ranging from 1.5i to 12inch, with prices that vary by a factor or more than 1 to 10. Therefore, any assumptions based on average COGS ignores the important of the mix of products which is essential.

The other element with major importance when analyzing COGS evolution is the evolution of €/$.

Another major factor in the recent years is the COVID related components shortage and price surge.

The conclusions of the report on COGS are therefore totally wrong.

Purchase prices from BOE have not evolved differently from that of other EMS and have followed the industry dynamics during both Covid and post-Covid periods. As a matter of fact, they stopped increasing over the course of 2022.

- Negotiations on arm’s length basis

The Group strategy is and has always been a multi-sourcing strategy for all suppliers, including EMS. It is all the more important given the fast growth in North America and the need to build a supply chain in the region. Historical examples of this supply chain flexibility also include the group’s establishment of a supply chain in Vietnam.

The Group also has a long-standing commitment and policy towards issuing RFP’s. If BOE responds to one of the company’s RFP’s, it goes without saying that this is a competitive bid including alternative EMS.

Purchasing terms and prices are not dictated by our EMS partners. SES-imagotag’s purchasing teams negotiate terms directly with most key components suppliers that make up the Bill of Materials. What is negotiated with the EMS is their specific assembly value add as well as non-strategic components which consist of a minor part of the total ESL purchasing cost.

BOE is managed like any other supplier, and the roles are clearly separate with its role of shareholder as it is explained in section 6 above.

-

SES-imagotag does never present itself as « SaaS company » but as the leading Retail IoT platform, with a large majority (85%) of its revenues coming from ESL hardware, and 15% of our revenues come from “Software, services and non-ESL solutions (VAS)”.

The Gotham City report confuses SAAS and VAS to suggest that the Group’s communications are misleading.

SES-imagotag has never presented itself as a « SAAS company » but as the leading Retail IoT platform, with a large majority (85%) of its revenues coming from ESL hardware.

15% of the Group’s revenues come from « Software, services and non-ESL solutions (VAS) ». VAS is the acronym for Value Added Solutions & Services. VAS revenues include: Vusion Software licenses and SAAS platform (see cloud metrics below), maintenance contracts, professional services (installations, set-up fees, project management, engineering services for custom solutions, …), Captana revenues from cameras, sensors and SAAS, Pulse and Memory Data analytics SAAS platform, Engage solution (Video-rail, digital signage and V-Ads SAAS platform), Industrial IoT solutions (PDI).

Today, SAAS revenues are still a minor fraction of the total VAS revenue, the largest part is still consisting of the other products and services. This will evolve with the rapidly increasing penetration of the cloud in the Group’s stores installed base. The Group’s SAAS capability and large scope of VAS solutions are recognized as one of its major differentiation and competitive advantage.

VAS revenues in 2022 amounted to €93m i.e., 15% of revenues as reported in our 2022 Universal Registration Document (page 177), compared to 85% for ESL. It is very clear in the Group’s communication that VAS is all revenues except ESLs. The Group shows the distinction between VAS and ESL because VAS, as a whole, represents a more profitable and more recurring set of solutions.

Note: The Group does not disclose the detailed breakdown of the VAS revenues by product for confidentiality reasons vs. our competitors, as it is a very distinctive aspect of the Group’s strategy, and before all these product lines to reach a critical size.

Cloud key metrics

Gotham City claims the following (p.31, p.35): “Limited real-world footprint” … “Limited Web traffic for their cloud URLs”… “6 out of the 7 written reviews on the Google Play Store complain that the VSION Link app doesn’t work”

As of December 31, 2022 and as reported in our 2022 Universal registration document (URD) on page 152, SES-imagotag manages more than 50 million electronic shelf labels (50,002,301) in 10,398 stores, increasing respectively by +61% and +48% vs. 2021.

The large majority of our new customers join the Group’s Cloud/SAAS platform and it is actually the case of all our new customers in the US.

The Group’s Cloud platform activity is intense and growing fast. As of May 2023, the Group can report the following impressive KPIs regarding the cloud platform activity:

- 61.5 million connected ESLs

- 14,041 connected stores

- 11,636 active API users just in the month of May 2023

- 135 million monthly API calls (May 2023)

- 423 million monthly IoT updates (May 2023)

The flawed statistics mentioned in the report are based on the URL vusion.cloud.io. but this link does not belong to SES-imagotag!

For information, VUSION Cloud is accessible to the Group’s customers through the following URLs, based on the respective geographies: https://manager-eu.vusion.io for Europe and https://manager-us.vusion.io the Americas

Reported customer NPS is high (55 in 2022) but the Group’s Cloud customers are showing an even higher NPS score.

The VUSION Link app is active in more than 13K devices on Android and in 2.5K active devices on iOS. But more importantly, most of the Group’s larger clients use private play stores to distribute our VUSION Link application to a very large number of users – all of which are unaccounted for in the public stores.

More generally, the Group’s platform is a Business-to-Business solution which operates IoT devices deployed in physical stores. There is therefore no business rationale for free trials, and the comparisons made are totally irrelevant.

R&D Teams

Gotham City claims the following (p.35): “Despite promoting itself as “the leading retail IoT SaaS solution” We find no mention of software engineers/developers/programmers under their employee ‘categories’”

The figures presented are representing the French employee headcount, presented as categories of employees (Managers, Supervisors and technicians, workers, apprentices under contract).

On page 119 of the Group’s 2022 Universal Registration Document, it is reported over 200 engineers within the Group working in 7 different R&D centers. The vast majority of the teams in the R&D centers in Paris, Cork, Ettenheim, Amiens, are software / cloud / AI focused.

Presentation per operating segment

Gotham City claims the following (p.41): “SESL seems to be intentionally blurring the perceived segments of its business” (…) “An entity shall report separately information about an operating segment that meets any of the following quantitative thresholds.” (…) So herein lies the deception: “On the one hand, SESL, in its audited financial statements, presents its business as if it consists of only one operating segment” (…) “On the other hand, SESL presents its business as if it consists of two segments, including a SaaS segment they label as VAS, in all its investor materials outside the scope of its auditors”

The Gotham City report is mistaken on IFRS 8 standard rules.

IFRS 8 defines an operating segment as follows. An operating segment is a component of an entity: [IFRS 8.2]

- that engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same entity)

- whose operating results are reviewed regularly by the entity’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance and

- for which discrete financial information is available.

Since these conditions are not all met regarding VAS, SES-imagotag is currently reporting on only one segment.

This topic is a dynamic assessment performed by the management of the Group and part of the procedures carried out by the auditors.

Regarding the presentation of our business to the investors, SES-imagotag has never mentioned or presented the VAS as an operating segment. As can be seen on the slides displayed in the report, the only information provided related to VAS is the revenue. Investor presentations are therefore consistent with the audited financial statements.

-

Walmart contract is profitable and consistent with the Vusion’27 plan

Gotham City claims the following (p.26): “We believe that WMT has become SESL’s largest customer accounting for 34% of SESL’s total 2022 revenue as described below (…) If we are correct that Walmart is SESL’s largest customer as of 2022, then Walmart has contributed EUR 211 million of 2022 revenues for SES. Based on the Walmart deal’s Phase 1 details, we estimate that the deal generates EUR 212 million on an annualized basis”.

SES-imagotag’s success relies on long-term partnership with its clients and partners. Long-term partnerships are based on reciprocity, meaning that both SES-imagotag and its clients perform all necessary due diligence such as technology, financials, governance, long-term business planning etc. before entering into commercial agreements.

In the context of the Walmart US partnership, which is significant because of its potential size, the Group ensures that it performed those due diligence very thoroughly. SES-imagotag would not enter into such agreements without ensuring compliance with its VUSION 27 plan, irrespective of the client.

Gotham City is grossly misrepresenting the relationship and the economics of the partnership by making false assumptions. As an example of the shallow analysis work performed by Gotham, Asia and America’s revenues for 2022 were reported as €134m in the Group’s annual report while Gotham claims €211m for the same period on Walmart alone. Furthermore, the roll-out contract in the U.S. announced on April 27, 2023, does not impact the Group’s 2022 revenues since “The contract will span several years, with a first phase of 500 locations over the next 12 to 18 months, for a total of 60 million digital shelf labels, with the opportunity to expand further within Walmart’s store fleet.”.

Gotham City claims the following (p.26): “With the BOE unwind, and SESL’ COGS per unit rising, we wonder how much margin SESL can generate. By our calculations, SESL would generate a large loss selling to WMT at EUR 5.30 per ESL, if SESL COGS per ESL remains at 2022 levels of EUR 6.66 per ESL, as shown below”.

In addition to the errors on COGS pointed out in section 7, the allegations made by the Gotham City Research are wrong and rely on easily debunked shallow analysis work.

First of all, as published on April 27, 2023: “Walmart will deploy for the first time ever the latest-generation VUSION platform, which was developed by SES-imagotag labs through an R&D program that has been in progress for more than ten years, with first patents filed as early as 2013.” Gotham City’s Report deliberately chose to not take that into consideration, preferring instead to rely on flawed historical data.

Second, basing the margin analysis of a specific contract based on historical blended datasets shows a limited understanding of the drivers of this industry. This would be similar to extrapolating the profitability of a specific new Smartphone model by looking at the historical industry average COGS of all Smartphones.

While SES-imagotag does not disclose detailed financial information linked to commercial contracts to respect the confidentiality agreements it has with its clients and partners, the Group can reaffirm that the contract signed with Walmart U.S. is consistent with the Vusion ’27 strategic plan growth and profitability targets.

Appendix

Gotham City claims the following (p.13): SESL’s explanations regarding its 2019 and 2020 licensing agreement with the JV are suspect

Adequate IP management with our former subsidiary (BOE Digital Technology Co. Ltd., the “JV”)

On royalties close to zero:

In 2019, SES-imagotag SA granted IP rights to our controlled subsidiary BOE Digital Technology Co. Ltd. to manufacture and distribute ESL products on the mainland China territory: the licensing agreement authorizes the JV to order ESL’s directly from the Chongqing plant and not through SES-imagotag SA for obvious pragmatic reasons, the two entities sitting in the same territory. This is the rationale behind the licensing contract granting a manufacturing right.

Since there was no point in charging this fee at the start-up phase in a Chinese market which was very price competitive, it was decided to not charge the first two years, and then to charge gradually over time an incremental fee (starting at 1%) to move up to the standard Group fee (3%) the following years, leaving time for the Chinese distribution entity to reach break-even. From a tax standpoint, that “license-free period” has to be short and justified by that start-up period, so due to OECD transfer price compliance reasons the licensing fee started to be charged in 2021. The date of signature and effective date are distant as related parties’ agreements have to be approved by the mother company board on the one hand and then the JV board.

On Cross-licensing

The cross-licensing agreement intends to allow co-innovation between SES-imagotag and BOE Digital Technology Co. Ltd. Specifically, SES-imagotag wants to leverage the local R&D capability to perform cost-down redesigns band innovations, developing new IP on the base of our initial IP. The cross licensing is enabling BOE Digital Technology Co. Ltd to develop their incremental IP (“the improvements”) on the base of SES-imagotag’s background IP and allows SES-imagotag to benefit from this incremental IP developed by BOE Digital Technology Co. Ltd. The Parties acknowledge that they will both get an equal benefit from the Cross-License. Therefore, the Parties agree that the Cross-License is made on a royalty-free basis since each Party is duly compensated by the rights granted by the other Party under this Agreement.

Gotham City claims the following (p.9): “SESL does not disclose these material related party payables and receivables transactions”.

This information is not required. The information required in the annual report is related to the purchases and the sales made with related parties. This information has been properly disclosed.

Deferred revenues

Gotham City claims the following (p.37): “SESL’s Deferred revenue levels and disclosures do not look like a SaaS company’s disclosures” “the levels of deferred revenue they report do not resemble those of SaaS companies either”

As already stated in this report. SES-imagotag has consistently reported that the vast majority of its revenues consisted of ESL (hardware) revenues.

Comparing the totality of the revenues including 85% ESL revenues to deferred revenues and comparing this ratio with that of a pure SaaS company is irrelevant.

Branding in China

Gotham City claims the following (p.23):

“In a WeChat post found on the JV’s WeChat page, and commenting on the award that the press release discussed, there are pictures showing BOE Vusion ESLs, with no mention of SES Imagotag”

In terms of the branding, it has been chosen in 2018 to leverage the strong brand equity of BOE in China, where SES-imagotag was totally unknown.

SES-imagotag’s combined general shareholders meeting of June 23, 2023

The shareholders of SES-imagotag gathered on June 23 at the company’s headquarters. During the Meeting, the Chairman and CEO of the SES-imagotag group, Thierry Gadou, presented the 2022 highlights of the Group, as well as the outlook for 2023. Thierry Lemaitre, Group CFO, presented the financial results for the 2022 financial year.

The auditors also presented their reports, which they prepared for the Meeting, giving unqualified audit reports in respect of the 2022 annual financial statements.

Following these presentations, the Combined General Meeting adopted by a large majority all of the resolutions.

Answering one of the questions, the management has indicated that SESIM, the company gathering the management and employees of the Company, which currently holds 12% of the share capital, may consider to strengthen its shareholding position at the Company in the coming weeks for an amount of

c. EUR 1 million.

Investor Relations contact:

Labrador – Raquel Lizarraga / +33 (0)6 46 71 55 20 / raquel.lizarraga.ext [at] ses-imagotag.com

Press contacts

Publicis Consultants

Audrey Malmenayde / +33 6 76 93 11 45 / audrey.malmenayde [at] publicisconsultants.com

Louis Silvestre / +33 6 24 31 06 76 / louis.silvestre [at] publicisconsultants.com

Disclaimer

Certain information included in this press release does not constitute historical data but constitutes forward-looking statements. These forward-looking statements are based on current beliefs, expectations and assumptions, including, without limitation, assumptions regarding the Company’s present and future business strategies and the economic environment in which the Company operates. They involve known and unknown risks, uncertainties and other factors, which may cause actual performance and results to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include those discussed and identified in Chapter 2 “Risk Factors” in the Universal Registration Document approved by the French Financial Markets Authority (AMF) and available on the Company’s website (www.ses-imagotag.com) and the AMF’s website (www.amf-france.org). These forward-looking information and statements are no guarantee of future performance.