In-store technology is reshaping operations, customer experience, and the bottom line

Retail is entering a new era. According to a new global Bain & Company-VusionGroup survey of 65 executives from worldwide leading retailers (June 2025), technology adoption is no longer an experiment, it’s the new standard for store operations and customer engagement. The findings reveal a sector doubling down on digitalization, betting on faster paybacks, and reshaping what the “store of the future” looks like.

Key Findings from the Bain-VusionGroup Report

- Tech investments are top of mind. Sixty percent of retail C-level executives are prioritizing in-store technology over other strategies, with plans to increase store capital expenditures by 5% to 20% over the next five years.

- Customer experience leads the way. Retailers’ top three customer-centric priorities are:

- Product availability (56%)

- Price integrity (53%)

- Better customer engagement (45%)

- Bottom-line impact is real. Nearly half (44%) of retailers expect store technology to improve margins by 1.5+ percentage points, a significant gain in an industry where margins are thin.

- Adoption is widespread.

- Nearly 60% of retailers have implemented electronic shelf labels (ESLs).

- 55% have rolled out self-checkout systems at scale.

- 44% are using RFID.

- 33% have introduced scan-and-go shopping.

- Faster ROI. Almost 70% of retailers now expect to recoup their technology investments in under three years.

“Product availability, price integrity, and customer engagement are the top three customer priorities for retailers today.”

Bain-VusionGroup Survey, June 2025

Why This Matters

The shift isn’t just about operational efficiency. Stores are evolving into hybrid hubs of commerce, media, and data:

- Enhanced experiences: AI-driven tools, from smart shelves to geolocation, are helping shoppers enjoy faster, frustration-free journeys.

- Operational gains: Automation is streamlining tasks like shelf restocking, price updates, and e-commerce fulfillment, allowing staff to focus on higher-value activities.

- New revenue streams: Retail media networks and digital in-store advertising are transforming static displays into dynamic, data-driven assets that unlock monetization opportunities.

As one example, Walmart has combined computer vision, RFID, and ESLs to create stores that serve both as shopping destinations and e-commerce fulfillment hubs—illustrating how integrated technology delivers measurable ROI.

Building Future-Proof Stores

The report also highlights that while retailers are testing an average of five technologies at once, challenges remain. Internal barriers such as slow decision-making (43%), compliance concerns (40%), and high costs (32%) often stall progress. Success depends on overcoming these hurdles with a clear roadmap:

- Start with customer and staff pain points.

- Build support at all organizational levels.

- Think in terms of platforms, not point solutions.

- Invest in both technology and workforce development.

- Integrate financial performance across online and offline channels.

“60% of retail executives are prioritizing in-store tech investments over other strategies.”

Bain-VusionGroup Survey, June 2025

The Road Ahead

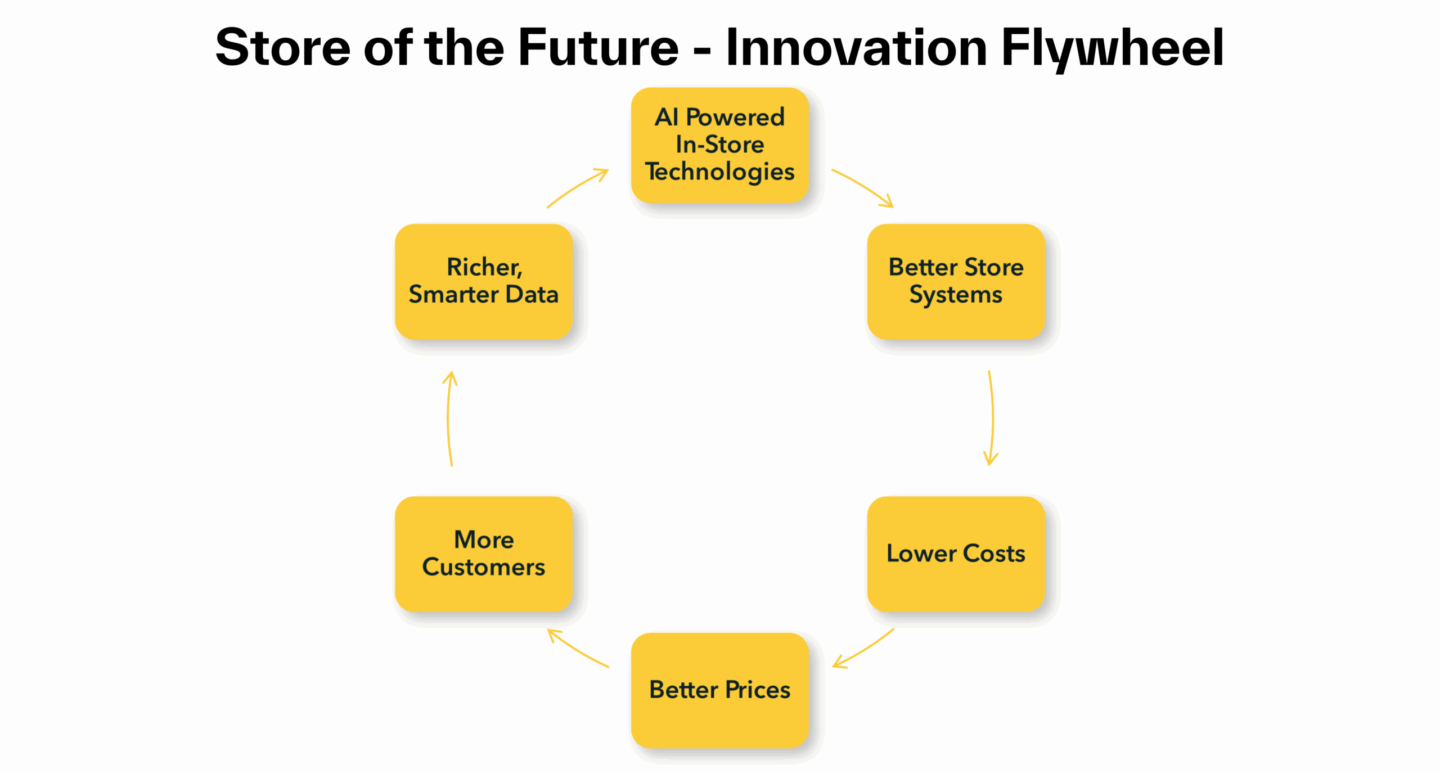

New in-store technologies improve store’s infrastructure and systems. Better systems cut costs. Lower costs enable better prices. Better prices bring in more customers. More customers generate richer data. And smarter data drives the next wave of retail innovation.

Retailers that embrace this flywheel today will not just survive, they will outpace the competition tomorrow.